Sophia Butt

Regime 42 & DDP 2026 Changes: Guide for UK Exporters

IMS Welcomes MJR as a Strategic Partner to Extend EDI, OS & IDF Capabilities

Unlock powerful new capabilities for your business. IMS has partnered with European IT specialist MJR GmbH to deliver expert-led solutions in Electronic Data Interchange (EDI), Infor OS, and Infor Development Framework (IDF). This partnership combines our strategic consultancy with deep technical implementation, offering you a holistic service with the added benefits of real-time, geographically aligned support for faster turnarounds and seamless collaboration.

Hiring an AS400 Programmer

The PSTI Act & Product Security: What you need to know

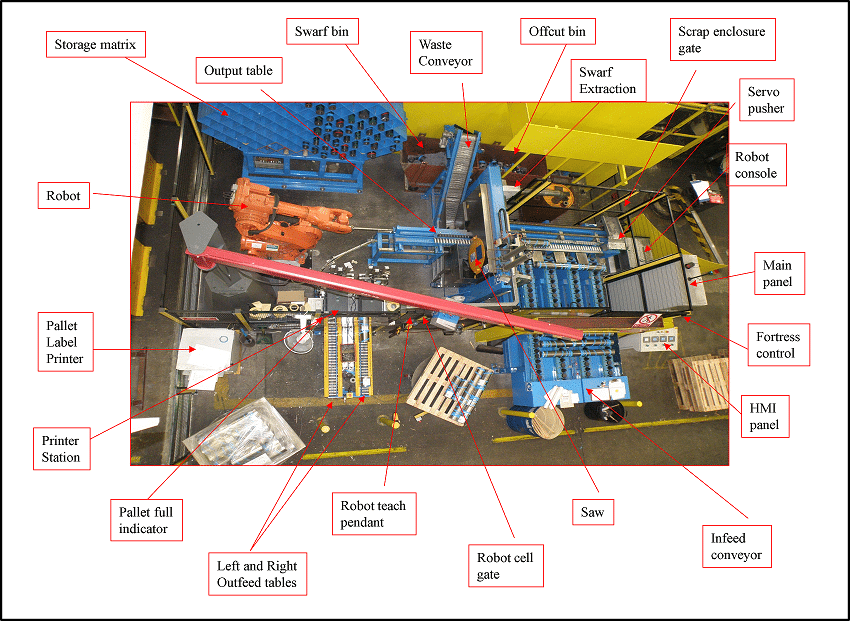

Case Study: Ecobat Resources Robosaw project

Ecobat, a global leader in lead production and recycling, relied on automated robotic saws integrated with their System 21 ERP to fulfill bespoke customer orders. 1 When migrating to SAP, maintaining this crucial automation was paramount to avoid manual intervention and wasted resources. Discover how the IMS team expertly rewrote the integration program, leveraging their diverse development skills to ensure a seamless transition and continued efficiency

IMS Essentials: How Utilities Can Help Your Business Run Smoothly

Facing the dual challenge of a skills shortage and the ever-present threat of costly IT downtime on your IBM i? You’re not alone. With research highlighting that even a single hour of downtime can cost businesses over £80,000, maintaining a smooth operation is critical. Introducing IMS Essentials, a suite of targeted utilities designed to alleviate these pressures.

Case Study: The System Audit

Understanding a complex ERP system is the first step to effective support. For Garador’s unique BRAIN system, this meant deciphering German commentary and mapping bespoke developments. IMS specialists undertook a comprehensive technical audit, meticulously exploring and documenting the entire system. This thorough approach enabled them to not only fix existing issues, like those in the purchase order process and 3rd party integrations, but also complete unfinished work, providing significant value to Garador.

Case Study: The Supplier Portal

For EI Electronics, improving the efficiency of their global supply chain hinged on better access to information. IMS delivered a powerful supplier portal that extracts and displays real-time data from their Aurora ERP. This case study illustrates how providing transparent, up-to-date insights into key metrics like spend, delivery performance, and urgent orders empowered both EI Electronics and their suppliers to make informed decisions, leading to increased productivity and a more robust supply chain.